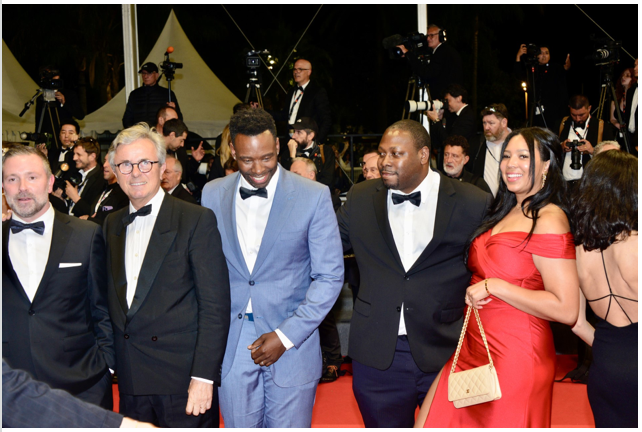

The film financier out of Atlanta, Georgia, Jon Gosier of FilmHedge, was very visible this year in Cannes. Aside from the banner on the Croisette advertising his office, his company sponsored the Producer’s Club for the second year and it graced the cover of the Cannes Market Guide. Who is this newly visible player? A discussion with Gosier follows.

His company, FilmHedge, along with his company Southbox Entertainment, announced a $25M partnership with Riveting Entertainment in which Gosier will be both investor and strategic advisor. Production on their first feature-length film will begin in Georgia this year.

FilmHedge also announced that Archstone Entertainment has secured worldwide sales rights to a film they financed called The December Cross.

This marks the second year that FilmHedge has sponsored the Cannes Film Festival Producers’ Club. They sponsor it, not because they are looking for producers. Producers themselves are always looking for money. They sponsor it so that they can educate the producers on how best to get that money. Things like equity vs. debt loans and how to get FilmHedge’s debt loans. The Film Financing Forum is the only program I know of that explains the business of film financing to filmmakers and that is the reason for Jon’s presence at the Producers’ Club.

Last year the Film Financing Forum focused on female filmmakers. Two of the largest investors in his company are women in venture capital. This year the focus has broadened but includes filmmakers from Africa and the African Diaspora.

Jon Gosier, the Founder and CEO of FilmHedge, is an entrepreneur, software developer, investor, and philanthropist. He graduated SCAD, The Savannah College of Art and Design and began his career in music at a recording studio. He always had an interest in movies, but at that time in Atlanta, there was no movie industry. When a “then-unknown guy” brought his movie to the studio, Gosier asked to be put on his session because of this interest.

The unknown guy was Tyler Perry doing some audio for the movie Diary of A Mad Black Woman. About two years later, Tyler Perry Studios reached out and asked him to join them as Music/Audio Supervisor. That made him one of the first employees to work at the illustrious Tyler Perry Studios, where he learned the ins and outs of closing media deals. Now Gosier is using his knowledge to help filmmakers finance feature films, TV series, and documentaries.

Fast forward ten years. After working for Tyler for a while, he quit to do his own thing as an entrepreneur and he built several technology companies across multiple continents, became an angel investor and dabbled as a venture capitalist.

Gosier founded Audigent, which is the leading data activation, curation, and identity platform used by major music publishers, including Warner Music, which now owns a substantial stake of the company. Jon, a native of Georgia, is also the founder of Southbox Entertainment (2018), a film and TV production and co-financing company based in Atlanta.

He was named as one of Ten African Tech Voices to Follow on Twitter by CNN and one of the 25 most influential African-Americans in Technology by Business Insider. He was awarded a TED Fellowship in 2009 and later named a TED Senior Fellow. He was born May 20, 1981 (age 42 years) in Reston, Virginia, United States and has also founded Appfrica, HiveColab, and Abayima.

Now Gosier is using his knowledge to help aspiring filmmakers find their footing by securing financing for their feature films, TV shows or documentaries.

Sydney: I liked how your CFO/COO, Josh Harris, explained it: “Technology and streaming has rewired entertainment consumption forever, pushing Hollywood to produce more content at greater speed. FilmHedge is built at the intersection of technology and entertainment and is uniquely positioned to influence the evolution of the film industry by creating efficiencies while deploying much needed private capital into a diverse marketplace.”

Josh Harris, with 20-plus years in institutional finance, worked as a lender on over $1 billion of film transactions and in leadership for top banks like RBC and Bank of Hawaii, supporting their corporate and commercial banking platforms. Most recently, he grew the entertainment financing division at City National Bank, an RBC company, helping to increase returns and expand the entertainment portfolio of businesses. Harris is steeped in regulatory know-how. His training and experience in financial services gives him the ability to forecast trends and anticipate market dynamics. His involvement in the entertainment financing vertical and working closely with studios, film, and television has resulted in Harris building a vast influential network at the nexus of Hollywood and Wall Street.

“Josh is an instrumental part of our executive team as a board member and co-founder, helping us secure our debt deal earlier this year and he has the creativity to improve how we deliver financial products to filmmakers. Josh’s acumen and experience in the C-suite will be vital to the growth of FilmHedge, as we continue to see a greater usage rate on our platform,” said Gosier.

Headquarted in Atlanta, Georgia, FilmHedge is a film and TV finance company that leverages proprietary technology to improve the lending process for filmmakers. FilmHedge is an alternative lender providing short-term debt financing up to $10 million dollars per film or TV series to qualified productions. The technology that FilmHedge has built upon is customized for the unique needs of the film and TV finance industry. Through the innovative application of this technology, FilmHedge can approve lending in a matter of days whereas legacy bank lenders can take weeks or even months. Because FilmHedge relies on technology for the underwriting process, another advantage is that there is no bias in the financing process.

Can you explain to me what non-equity means?

It means debt financing. We don’t own the film or have a share (equity) in the film. We are loaning money to the film company to make the film.

Could you explain to me the differences between venture capital, private equity and hedge funds?

Venture capitalists are only privately held companies using other people’s money to drive up the paper value of other privately owned companies. They can remain privately owned up to 10 years or more before going public. That is a long time to wait for a return on the investment. They typically start early with start-up companies which then go public or are flipped to other owners.

Private equity firms invest a mix of private and public traded companies. They have shorter return times but also less return on the investment, but they have more deals than VC companies.

Hedge funds are a mix of both of the above. We invest in private and public companies and have both long and short positions.

How do you determine what films to make loans to?

To secure lending from FilmHedge, the production must satisfy our key criteria. First, the borrowers must have sufficient collateral for their production. The film must also have a completion bond, a type of insurance that guarantees a film will be completed or the financial backers will be made whole. FilmHedge considers distribution agreements (with payment clauses known as minimum guarantees), tax credits, and pre-sales as collateral.

FilmHedge earns a net average of 11.28%, which is believed to be above the industry average. Gosier believes transparency is critical to the industry, which is why his company publicly publishes an annual report detailing returns. In 2021, FilmHedge directed $101 million into 10 feature films which generated $113 million within 12 months.

FilmHedge’s technology monitors for production redflags that can result in severe financial problems like going over-budget, misappropriation of funds, and fraud. The software FilmHedge employs monitors in real-time producer spending and transactions via an easy-to-use dashboard that allows investors to see things like allocation of monies, interest earned, and more. You can see an example here.

With increased scrutiny and regulatory oversight of traditional banks brought on by the recent failure of high-profile banks, it’s become more difficult for filmmakers to access capital. This is a gap FilmHedge seeks to fill and the company has already seen increased demand in the past few months.

How can you guarantee such an ROI?

In short, it goes back to the criteria we require for FilmHedge to fund a production. We only fund deals that are bonded and where there’s essentially already a buyer or other financial stakeholders in place. The agreements between the producer and these stakeholders serve as collateral for us.

What about the recent bank failures? How are you affected?

When we began in 2020, COVID broke out. Now there are bank failures. FilmHedge provides private credit. We lend funding to the project, not the filmmaker. Private credit is attractive for investors, and film financing offers a reliable, relatively quick return akin to other asset classes like real estate, trade finance, or factoring.

Also consider that in turbulent economic times, three things thrive: guns, liquor, and entertainment. As a critical piece of the entertainment puzzle, FilmHedge stands to benefit in times like these when compared to traditional investment paths.

OK, now for the hard questions:

Can you explain the systemic exclusion of Blacks in film financing?

The perception that financing is tilted against a particular group is not that easy. The reality is that a lot of filmmakers simply do not understand how the industry works. And the financing part can be daunting for creatives who invest so much of their energy on developing scripts. Filmmakers have to learn how the business side of the system works. The system, in large part, is not broken. Many filmmakers run into a wall and they think it’s because of x, but it is not always the case. And with FilmHedge in particular, we have improved the system to virtually eliminate any discrimination when it comes to who gets funding and who does not. Our system approves deals exclusively based on quantitative attributes, either there’s collateral in place or there isn’t. That’s as objective and equitable as it gets. It is looking strictly at whether or not the production has met our criteria for funding. I spend a lot of time and do a lot of mentoring with emerging filmmakers educating on the basics of film finance. Once you understand how the system works, you can work within it.

Well you can say that, but I know plenty of women who are well qualified who cannot raise money because the Hollywood old boy’s network does exclude them. If there are more projects looking for money than there is money, choices get made ln who gets that money.

I am not saying the industry is free of blame. The entertainment industry faces the same systemic issues other industries face no doubt. That is why it’s important to educate marginalized groups on how to work the system, and in the case of FilmHedge, how to access funding. I can tell you that Georgia is a welcoming home for mainstream filmmakers, as well as marginalized groups. Our open minds and innovative spirit is part of what makes Georgia the top destination for production, outpacing even Hollywood.

Why did FilmHedge establish roots in Atlanta?

During the 2021 fiscal year, the film and television industry set records with $4 billion in direct spending on productions in the state of Georgia. This industry spending was the result of 366 productions filmed in the state — represented by 21 feature films, 45 independent films, 222 television and episodic productions, 57 commercials, and 21 music videos.

Georgia has led the industry in production-friendly policy that has brought blue chip talent and spending to the state. These policies also bring investment, this transaction being a great example.

I also grew up here.

Perks of filming in Georgia:

In Georgia, entertainment tax credits are coveted by TV and Film producers. The State’s film, television, and digital entertainment tax credit of 30% offers significant cost savings for those producing feature films, television series, music videos and commercials, as well as interactive games and animation.

Georgia Film and TV Tax Credit Jumps to a Record $1.2 Billion

Through the Entertainment Industry Investment Act, Georgia provides a 20% tax credit for companies that spend $500,000 or more on production and post-production in-state, either in a single production or across multiple projects. The state grants these productions an additional 10 percent tax credit if the finished project includes a promotional logo in the end credits.

How is Georgia’s election-fraud, anti-abortion and pro-gun stand affecting funds and filming there? I know I myself am guilty of condemning a political stance, but if there is still money to be gotten, I will go after it and I imagine filmmakers concur.

Well so far the rhetoric has not resulted in any policy changes. But politicians need to calculate the risk they are taking with their words.

Yes they should look both ways before crossing the line. You know how they use code words about Hollywood…Meanwhile, it’s business as usual, or as unusual, because it is an unusual business.

Thank you for your time.

You are welcome. Just to summarize:

FilmHedge financing is available to fill gaps in Pre-Production, Production, Post-Production, Re-shoots, or Finishing: FilmHedge provides private credit financing to Film and TV producers up to $10 million per production. We offer short term financing to borrowers working in Film, TV, and Media. Forms of collateral for lending include corporate media agreements like distribution, minimum guarantees, pre-sales, and federal or state tax credits etc.

Upon approval, in 24 to 72 hours applicants can receive the capital needed to complete their project. Types of funding does FilmHedge offer to borrowers:

-Gap Loans

-Bridge Loans

-Finishing Funds

-Liquidity Financing (i.e. Line of Credit)

Term Loans: Up to $10M*

Lines of Credit: Up to $25M*

Typically film projects with total budgets between $1 million and $50 million or TV projects with budgets of at least $500 thousand per episode. Additionally, we primarily finance productions that have, or intend to get, completion bonds.

No development funds. No full budgets (100%)

What’s Happening in Georgia? The Atlanta Film Industry in 2021